Latin America is rapidly transforming into the “new Europe” for traffic arbitrage specialists in the financial sector. In 2024, the volume of internet audience and digital advertising in the region reached record levels: the LatAm digital advertising market is valued at $22.25 billion and is growing at double-digit rates thanks to the boom in video advertising and retail media, while improving economic conditions in Brazil and Mexico are taking the market to new heights.

Latin America is rapidly transforming into the “new Europe” for traffic arbitrage specialists in the financial sector. In 2024, the volume of internet audience and digital advertising in the region reached record levels: the LatAm digital advertising market is valued at $22.25 billion and is growing at double-digit rates thanks to the boom in video advertising and retail media, while improving economic conditions in Brazil and Mexico are taking the market to new heights.

The share of digital in total advertising spending has exceeded 50%, and for the first time in 2024, even countries like Argentina and Chile (where TV previously dominated) have reached this level. Against this backdrop, Mexico, Brazil, and Chile particularly stand out – countries that have become a magnet for traffic arbitrage in the financial vertical (especially for MFIs – microfinance institutions).

In this analytical article, we’ll examine market trends, the attractiveness of these geos, traffic statistics, audience characteristics, and prospects for financial traffic development in the region for 2025. Rapid Growth and Digitalization

Rapid Growth and Digitalization

The online traffic market in Latin America’s financial sector is showing explosive growth. The number of internet users and the level of Internet penetration have already approached the indicators of developed countries. For example, Brazil had 187.9 million internet users (86.6% of the population) at the beginning of 2024, Mexico had 107.3 million (83.2%), and Chile had 17.88 million (91.0%).

Social media audiences are also actively growing: 66-77% of the population in these countries use social media, creating enormous opportunities for digital marketing of financial services. Overall, in the LatAm region, digital advertising continues to grow at double-digit rates in 2024 – especially in video and e-commerce advertising segments. This means that financial advertisers are also increasing investments in online channels.

Shift to Digital

It’s important that businesses in Latin America are rapidly shifting budgets from traditional media to online. While digital has long dominated in Europe and North America, advertisers in LatAm are increasingly relying on the internet.

For instance, in Chile in 2024, the share of internet advertising exceeded 50% of total ad spend for the first time (a similar turning point that Europe passed several years ago). This indicates market maturity: financial brands have recognized the effectiveness of digital channels for customer acquisition and are actively investing in them.

Further growth of internet advertising in the financial vertical is forecasted for 2025, as smartphone penetration and online banking continue to increase, and consumers increasingly trust digital financial services.

The Role of Fintech and MFIs

The boom in fintech startups and microfinance institutions in the region deserves special mention. A large portion of the LatAm population has historically been underbanked (a significant percentage of “unbanked”), so in 2024 we’re observing explosive growth in online microcredit services, digital wallets, installment plans (BNPL), and more.

This creates strong demand for financial traffic – leads for loans, credit cards, insurance, etc. MFIs pay generously for quality traffic as they try to capture market share, and arbitrage specialists are taking advantage of this.

Dozens of MFIs operate in Mexico and Brazil, competing for online customers, creating favorable conditions for affiliate marketing in the financial niche. In 2024, many affiliates have redirected their focus from saturated EU markets to LatAm, seeing opportunities for scale and high ROI here. Scale and Buying Power

Scale and Buying Power

Mexico, Brazil, and Chile are often called the “new Europe” in arbitrage slang due to their combination of large solvent audiences and relatively low competition from advertisers (compared to Europe).

First, these are large markets: Brazil has over 210 million people, Mexico has ~129 million, and Chile has ~19.6 million. Internet penetration has already reached 80-90% of the population – meaning the digital audience is comparable to large European countries.

Second, urbanization levels and average incomes are sufficient for people to actively use financial products. For example, Chile’s GDP per capita approaches Eastern European levels and has one of the most stable economies in the region, while Mexico is a G20 member.

For traffic arbitrage specialists, this means that traffic from these countries converts no worse than European traffic, as users have real needs and the ability to take out loans, credit, insurance policies, etc.

High Online Activity

The internet audience in these countries is not only numerous but also spends a lot of time online – often more than Europeans. According to research, Brazil, Chile, and Mexico are in the top 10 countries worldwide for time spent on social networks.

Brazilians, for example, spend an average of 3 hours 38 minutes per day on social networks, Chileans – 3 hours 26 minutes, Mexicans – 3 hours 15 minutes (for comparison, the global average is ~2 hours 19 minutes). This is even more than in many European countries.

Such high engagement levels mean more opportunities to show ads and drive users to conversion. LatAm users actively consume content, click on ads, install apps – in short, the traffic is “hot” and responds to offers no worse than Western traffic.

Lower Competition and Click Costs

Another factor of attractiveness is that these countries currently have lower competition between advertisers than in Europe, especially in the financial offers niche. Many local financial companies are just beginning to master complex performance marketing tools, so arbitrage specialists can buy traffic relatively cheaply.

For example, the average cost per click (CPC) on Facebook in the “Finance & Insurance” category globally is around $1 (for traffic campaigns), but in LatAm it’s often lower due to cheaper inventory and less competition. Similarly, Google PPC for Spanish or Portuguese keywords can cost several times less than similar financial keywords in English in the EU/USA.

This gives traffic specialists higher ROI with proper optimization. Effectively, LatAm offers European-level conversion at “Asian” click prices, which makes these geos so desirable. Of course, competition is growing as new players enter, but the “window of opportunity” is still open.

Local Demand Factors

Mexico, Brazil, and Chile also benefit from local economic factors. In many European countries, the consumer credit market is already saturated, the population has access to banks and credit cards, so MFI offers are less in demand there.

In Latin America, a significant portion of the population needs microloans due to low banking penetration and income inequality. For example, young people and low-wage workers often don’t have credit histories for banks but turn to online MFIs – and this represents millions of potential clients.

Thus, financial offers (payday loans, installment plans, quick loans) enjoy enormous demand and high conversion, as they address real needs. In Chile and Mexico, microcredit services sometimes offer the first loan at “0% interest,” which further encourages users to apply – the arbitrage specialist gets a conversion, and the MFI gets a chance to retain the customer longer.

This situation is similar to Europe 5-10 years ago when the microcredit market was booming – hence the parallel that LatAm is now experiencing its “financial digital revolution,” just as Europe once did. As the table shows, all three countries have internet audiences comparable to European markets. For instance, Mexico has ~107 million people online – more than the population of any individual EU country except Germany. Brazil’s internet audience (188 million) is second only to the USA, China, and India.

As the table shows, all three countries have internet audiences comparable to European markets. For instance, Mexico has ~107 million people online – more than the population of any individual EU country except Germany. Brazil’s internet audience (188 million) is second only to the USA, China, and India.

The quality of this traffic is also high: almost all of it is mobile (the number of mobile connections often exceeds the population, as many people have 2 SIM cards) and socialized. In Chile, 77% of the population is active on social networks – comparable to Southern Europe.

The median age of users is significantly lower than in Europe (for example, the median age in Ukraine is ~41, in Spain ~45; while in Mexico it’s only 30). Younger audiences are more open to new digital services and more likely to take microloans online.

Also noteworthy is the high internet penetration in Chile – 91%, essentially at the level of Germany or France. This confirms that the Chilean market is very “digital” and almost the entire solvent part of the population is accessible through online advertising.

Conversion and LTV

Traffic quality is also reflected in conversion rates. Exact CR (conversion rate) figures depend on the offer and source, but affiliates note that financial offers in Mexico and Brazil deliver comparable conversion to Western GEOs.

For example, with properly targeted Facebook advertising, you can achieve 5-8% conversion from lead to issued loan, depending on offer conditions. On Google search, conversion can be even higher, as it captures “warm” demand (people actively searching for “crédito online rápido,” etc.).

Importantly, the average check and LTV of customers in LatAm is growing – while loans used to be very small, in 2024 financial companies are offering larger products (credit lines, installment plans for goods), meaning earnings per customer are increasing.

As a result, partner payouts (CPA/RevShare) for financial offers in LatAm have increased over the past year, approaching European levels. Thus, the growth in audience volume is combined with improved monetization per lead, making these countries extremely attractive. Young Core Audience

Young Core Audience

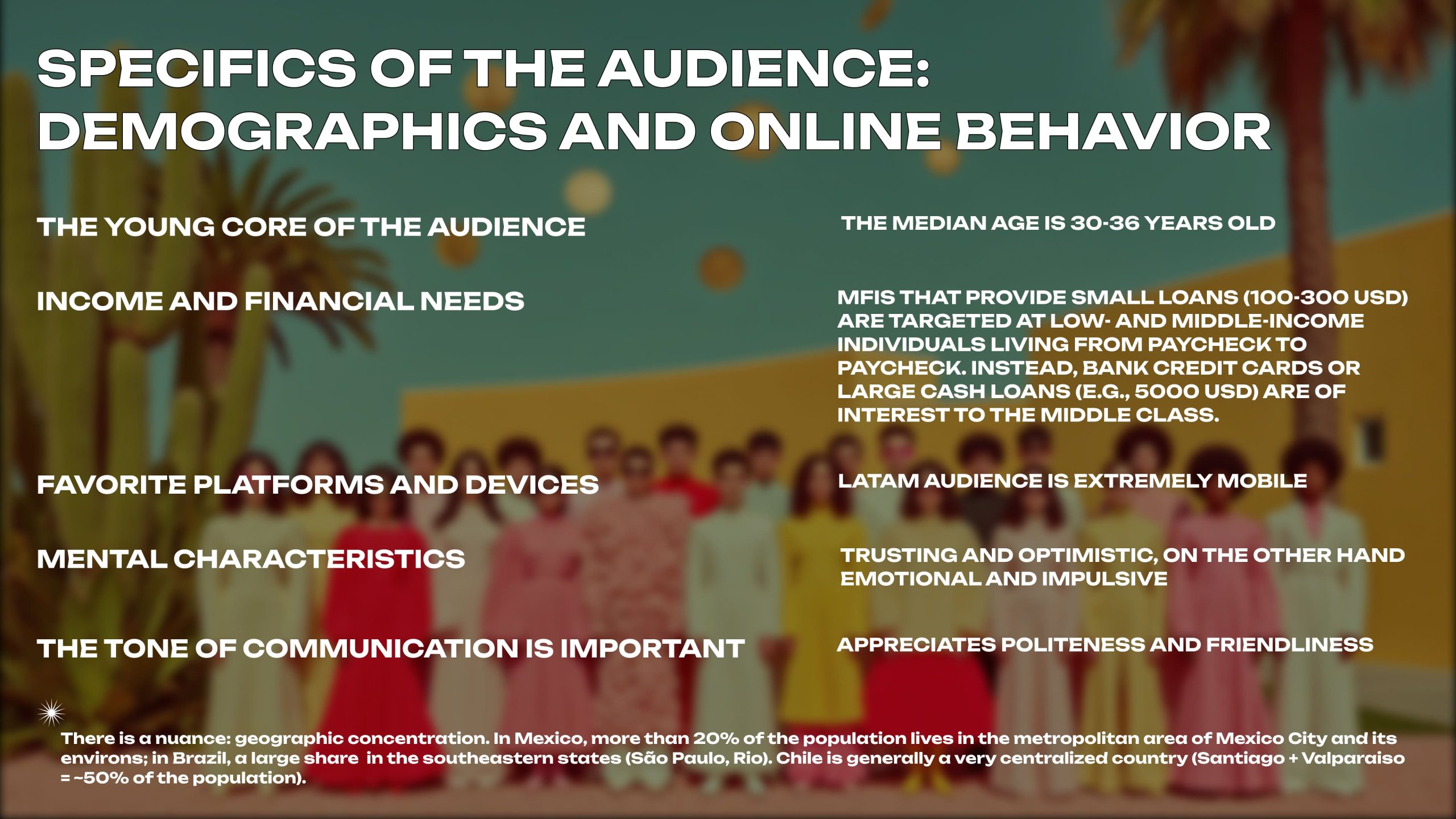

As mentioned, demographically, internet users in Mexico, Brazil, and Chile are significantly younger than Europeans. The median age is 30-36 years, with a large proportion in the 18-34 group. This means that the main segment targeted by financial advertising is millennials and Generation Z.

They are more tech-savvy, constantly on their smartphones, but may earn less and more often need “payday” loans. For this young audience, digital channels, interactivity, and speed are important.

It’s worth considering that communication language needs to be adjusted accordingly: simple, modern, without bureaucratic jargon. Unlike older generations, youth respond better to jokes and memes in advertising (even in financial themes). For example, in Brazil, a campaign by one credit service used a viral meme about footballer Neymar to illustrate “fell down – get financial help” and it resonated with the audience.

Income and Financial Needs

These countries have quite diverse income levels. Chile stands out with a relatively higher middle class: many professionals with stable salaries who can take out car loans, mortgages, etc.

Mexico has a greater gap: there are wealthy segments and many people with informal incomes. Brazil is also known for inequality but has a large mass of middle-income population.

For an arbitrage specialist, this means understanding who a specific offer targets. MFIs issuing small loans ($100-300) target low- and middle-income individuals living paycheck-to-paycheck. In contrast, bank credit cards or large cash loans (e.g., $5000) appeal to the middle class.

Online behavior also differs: more affluent audiences may read reviews and search for better interest rates (they can be captured through SEO articles like “where to find the cheapest loan”), while less affluent respond to bright advertising promising quick money without too many questions.

Favorite Platforms and Devices

The LatAm audience is extremely mobile – the share of mobile traffic exceeds 85-90%. Smartphones are the main device for internet access for most people. Popular brands are affordable Android devices (Samsung, Xiaomi, Motorola); fewer people have iPhones, mainly in large cities.

This is important to consider: for example, page weight should be small so it loads even on budget phones with slow internet.

In terms of social networks, WhatsApp is the absolute leader in communications (used universally for chat and even business purposes). Facebook and Instagram rank second in daily activity. YouTube has huge reach – many users perceive it as television. Twitter is less popular (mainly among urban intellectuals and for news). TikTok has gained traction among youth over the past 2 years.

It’s useful for arbitrage specialists to know that users often switch between platforms: for instance, after seeing an ad on Instagram, they might look for company reviews on YouTube or ask friends on WhatsApp. Therefore, the brand’s reputation footprint also matters: it’s good to have positive reviews on popular review sites or forums, so if a user Googles the MFI name, they don’t find negative content that would deter them from converting.

Mental Characteristics

The Latin American audience is, on one hand, trusting and optimistic, and on the other – emotional and impulsive. This means advertising that appeals to emotions works well: “fulfill your dream, buy this and that, money is not a problem, we’ll help you.”

Most people don’t plan finances too strictly and can be tempted by “money here and now” offers. MFIs leverage this in their advertising.

The tone of communication is important: LatAm audiences value politeness and friendliness. In communications, it’s better to use an informal tone (in Spanish – “tú” instead of “usted” for youth, in Portuguese – “você” instead of “senhor/a”), as if a friend is giving advice. Social proof also works: “500,000 Chileans have already received loans – join them.” This creates the effect that the service is widely used and reliable.

Multi-regional Audience

There’s a nuance: geographic concentration. In Mexico, over 20% of the population lives in Mexico City metropolitan area and surroundings; in Brazil, a large proportion lives in the southeastern states (São Paulo, Rio). Chile is an even more centralized country (Santiago + Valparaíso = ~50% of the population).

This means that a significant portion of traffic will come from these regions. In principle, this is good because cities have higher probability of solvency and internet access. But it’s worth remembering the cultural differences within countries: for example, people in northern Mexico have somewhat different consumer habits than in the south.

If possible, campaigns can be segmented by region to test different approaches (for instance, a more modern tone of voice for the capital, simpler messages for the provinces). However, this isn’t necessary at initial stages – you can target the whole country, as platforms optimize displays to areas with better response anyway. Based on current trends, 2025 promises continued boom in financial traffic in Latin America. Here are some expected developments and forecasts:

Based on current trends, 2025 promises continued boom in financial traffic in Latin America. Here are some expected developments and forecasts:

Further Growth of Digital Audience

The number of internet users will be even larger. For example, it’s projected that in Mexico, internet penetration will reach ~88-90%, adding several million new users in 2025. Brazil will approach 90%, Chile – 95%. These are new potential customers for financial products.

Additionally, existing users will spend even more time online, especially on mobile devices. Social networks and messengers will solidify their role as the main “living space” for people. Thus, advertising inventory will be even more capacious, and opportunities to reach the target audience will increase.

More Fintech Services – More Offers

The LatAm financial sector will continue its digital transformation. The emergence of new neobanks, online insurance, installment services is expected. For example, Brazilian fintech Nubank has already become one of the largest in the world, driving interest in online products.

In 2025, we may see new players entering the market and offering affiliate programs. Traditional banks will also invest more in CPA: they’ll issue their own credit card offers with payment for card issuance.

For arbitrage specialists, this means expansion of the pool of offers in the financial vertical. If most offers now are for MFI microloans, in the future there will be offers for online auto insurance, mortgage leads, investment apps, etc. Accordingly, it will be possible to diversify income sources.

Growing Competition and Professionalization

The market will inevitably become more competitive. In 2025, more local advertising agencies and media buyers will pour budgets into performance for financial clients. International affiliates will also strengthen their positions in LatAm. This will lead to higher rates for traffic and require a more professional approach.

Simple schemes may not work as well – data-driven marketing, deep analytics, audience segmentation, and AI optimization will be needed. This means the entry threshold will rise: it will be harder for newcomers, while those who gained experience in 2024 will have an advantage.

Obviously, CPA networks will also compete more actively for affiliates, offering better conditions and exclusives – the market will become more structured.

Possible Regulatory Innovations

LatAm countries’ authorities are closely monitoring the rapid growth of lending. It’s possible that in 2025, unified transparency standards for online loans will be introduced: for example, all MFIs may be required to clearly show the full cost of loans in advertising.

Data protection regulations similar to GDPR may also appear, as privacy issues are becoming global. If such laws are passed, marketers will need to adapt (collect cookie consent, etc.).

On the positive side, governments may launch financial literacy programs, which would indirectly increase public trust in legal financial services (and they would more often take loans from licensed companies rather than shadow lenders).

New Channels and Technologies

2025 may bring new opportunities: for example, wider implementation of WhatsApp channel for advertising (Meta may open more advertising integrations in WhatsApp).

Telegram is slowly growing in LatAm – it could become a platform for bots that process loan applications directly in the messenger. AI and chatbots will be used for lead processing: users will communicate with bots that help select loans – this can increase conversion, and the arbitrage specialist’s task will be to bring people to that bot.

We also expect the development of Connected TV advertising – many Latin Americans watch Smart TV (YouTube, Netflix with ads), and financial brands may enter this space. For arbitrage specialists, this is still a distant channel, but it’s worth monitoring technological developments. Mexico, Brazil, and Chile at the threshold of 2025 have indeed become for financial arbitrage what Europe was several years ago: a large, growing, and profitable market combining a broad internet audience, high demand for financial services, and the relative novelty of digital marketing.

Mexico, Brazil, and Chile at the threshold of 2025 have indeed become for financial arbitrage what Europe was several years ago: a large, growing, and profitable market combining a broad internet audience, high demand for financial services, and the relative novelty of digital marketing.

Features that make the region attractive for financial traffic arbitrage:

- Large digital audience with high internet penetration (83-91%) and social networks (66-77%)

- Young demographics (median age 30-36 years) with significant time spent online

- High need for financial products due to insufficient banking coverage

- Growing fintech and MFI market with competitive struggle for customers

- Lower traffic costs compared to European or American markets

- Good conversion, comparable to European, and growing customer LTV

The overall forecast is optimistic: the LatAm financial traffic market in 2025 will continue to “mature” and approach the maturity of the European market, while remaining highly profitable for those who have mastered its specifics. Mexico, Brazil, and Chile will solidify their status as key geos in the region. These countries will likely continue to surprise with high growth rates in the digital segment and new successful cases in arbitrage.

For arbitrage specialists looking for new markets after the “burnout” of European ones, LatAm represents an ideal opportunity: a sufficiently large but not yet oversaturated market with an active audience that needs financial products and services.

Sources

- We Are Social & Hootsuite “Digital 2024 Global Overview Report” – statistics of internet users, social media penetration

- Statista “Digital Advertising in Latin America” – data on the digital advertising market in the region

- eMarketer “Latin America Ad Spending Forecast 2024-2025” – forecasts of advertising market growth

- GlobalWebIndex “Social Media Time Spent 2024” – data on time spent on social networks

- World Bank “Financial Inclusion Data” – statistics on banking coverage

- Facebook for Business “Advertising Costs Benchmark Report 2024” – comparative data on CPC costs

- McKinsey & Company “Digital Banking in Latin America” – analysis of fintech sector development in the region

- CIA World Factbook – demographic indicators of countries

- Internet World Stats – data on internet penetration

- Affiliate Marketing Industry Surveys 2024 – trends in affiliate marketing