PDLP (PDL-Profit) is an international CPA platform specializing in monetizing traffic in the financial services niche – primarily PayDay Loans (PDL) and online loans/personal credits. The network launched in 2019 and has grown rapidly: it now unites over 10,000 publishers and offers 300+ verified offers from legal microfinance companies in more than 20 geos worldwide.

PDLP’s core values for partners are carefully selected reliable offers (only verified advertisers), complete support at all stages, and stable payouts without delays. Payouts and Financial Terms

Payouts and Financial Terms

PDLP stands out for its flexible and transparent payout conditions. Commissions are paid daily on request, without delays – in fact, the network practices instant payouts (0-day) for those who provide quality traffic. The minimum withdrawal amount is $50, with over 10 payment methods available (bank cards, PayPal, Payoneer, WebMoney, USDT cryptocurrencies, etc.).

In reviews, webmasters note that PDLP pays with maximum efficiency and “without holds, very flexible and fast” – even during the most difficult business periods, the network remained reliable (during force majeure situations like war or COVID-19, PDLP was the only one to execute all partner payments on time).

This approach ensures webmaster trust and allows for reinvesting profits into traffic without delays.

Technical Tools and Capabilities

As a specialized financial affiliate network, PDLP provides publishers with all necessary tools to maximize conversions.

In particular, an intelligent Smartlink is available – one universal smart link that automatically selects the best offer for each user using AI algorithms (geo, device, behavior analysis, etc.). This significantly increases conversion since the system offers the user the most relevant loan.

There’s also a convenient website builder/white-label available: webmasters can create their own financial micro-landing or showcase with offers for any geo in minutes (PDLP has ready templates for popular countries). You can use the platform’s domain or connect your own, customize the offer list, their ranking, set up postback.

For experienced arbitrageurs, there’s a flexible API for integration – through the API you can automatically update offer data on your own sites, get statistics, connect application widgets, etc.

Worth mentioning separately is the SMS Sender tool for broadcasts (up to 4,000 free SMS monthly) and GA4/Facebook Pixel integrations – all this helps increase ROI and optimize campaigns.

Support for Publishers

PDLP has built a reputation as a client-oriented network. Each partner has a personal manager who is available practically 24/7 and helps select offers, establish connections, and resolve any issues. Reviews confirm the high level of support: “24/7 support, variety of offers and highest rates,” writes one of the affiliates.

Managers help beginners from the first steps (even if you have little experience), while top partners receive extended capabilities and individual conditions.

The network has a loyal attitude toward traffic, accepting almost all legal sources (PPC, SEO, SMM, email, in-app, etc.) – only fraudulent or incentivized methods that distort quality are prohibited, as well as some types of context (directly to the advertiser’s brand).

This approach, combined with transparent analytics in their own tracking system, gives webmasters confidence in collaboration. PDLP has global coverage, focusing on markets with high demand for online lending. Among the network’s priority geos are Mexico, India, Kazakhstan, Romania, Ukraine, Philippines, Vietnam, Poland, Spain, etc.

PDLP has global coverage, focusing on markets with high demand for online lending. Among the network’s priority geos are Mexico, India, Kazakhstan, Romania, Ukraine, Philippines, Vietnam, Poland, Spain, etc.

Each of these markets has its specificity – level of financial services penetration, borrower behavior, demand seasonality, and working traffic sources. PDLP offers local offers for each country, with high CPL/CPS rates and landings adapted to local realities.

Let’s examine the features and most profitable propositions for each direction: Market. The Mexican online lending market is one of the most promising in Latin America. A large percentage of the population here is not covered by banking services (has no accounts or credit cards), which is why demand for microcredits is rapidly growing. The economic situation in the country is unstable, many families have low income levels (Mexico belongs to Tier-3 countries), so the need for “extra” money until payday is very high.

Market. The Mexican online lending market is one of the most promising in Latin America. A large percentage of the population here is not covered by banking services (has no accounts or credit cards), which is why demand for microcredits is rapidly growing. The economic situation in the country is unstable, many families have low income levels (Mexico belongs to Tier-3 countries), so the need for “extra” money until payday is very high.

In fact, the microloans culture is just forming, and now is a very good time to enter this vertical while competition isn’t oversaturated. At the same time, internet has already widely penetrated Mexico: as of 2024, over 83% of the population (107 million people) use the internet, and 97% of adults have smartphones. People actively use social media (more than 90 million Mexicans are active on social networks) – meaning the audience can be reached through digital channels massively.

Additionally, paid traffic cost in Mexico is relatively low, allowing arbitrageurs to spend budget more efficiently and get better ROI.

Credit demand is present year-round; noticeable peaks can be before major holidays (New Year, Christmas season), when family expenses increase. Generally, Mexicans take loans for everyday needs and small business development, the borrower age category is mainly 24-55 years. The most solvent and active audience is concentrated in megacities – Mexico City, Guadalajara, Monterrey.

In Mexico, the PDLP platform presents many local MFIs and fintech brands. Most popular offers: Kueski (CPL) – 60 MXN, Santander (CPS) – 210 MXN, Slana (CPS) – $26, LendSwap (CPS1 – $16.65, CPS2 – $12.50, CPS3 – $8.30), Kimbi (CPS1) – $6.00

Partners note that eCPC (earnings per click) on Mexican loans can reach $0.5-0.6 and higher – meaning traffic monetizes effectively.

For Mexico, various traffic sources work well, but the most powerful channel is SEO. According to analytics, up to 40-50% of all conversions in the PDL niche come from organic search. Mexicans actively google financial solutions, so content sites, MFI reviews, credit comparisons are an excellent strategy. By investing in SEO promotion for popular queries (for example, “crédito rápido en línea”), webmasters get a stable flow of high-quality leads.

In second place is Google Ads contextual advertising (~30-40% of traffic). Paid ads in Google allow capturing hot demand – users who are looking for online loans right now. A properly configured PPC campaign (considering geography, demographics, keywords) can give a high level of conversion to applications thanks to precise targeting.

The third important channel is social media (Facebook, Instagram, etc.) which provides approximately 20-30% of traffic. Facebook is extremely popular in Mexico – used by over 93% of the internet audience. WhatsApp (~92%) and Instagram (~80%) also have colossal reach. TikTok is a relatively “young” channel (approximately 76.5% of the audience has this app), but it’s developing dynamically – TikTok algorithms are still forming, so paid advertising there is less predictable. However, creative videos with the right messages can gather leads from there too.

Generally, social media is a good additional tool: through Facebook/Instagram you can interact with users, launch targeted advertising for different segments (for example, separately for men 20-30 or mothers with children, etc.). Email marketing and SMS broadcasts are also used in Mexico (10-20% total) for warming leads or returning repeat clients. Of course, the best result comes from a combination of channels – when the webmaster has a comprehensive presence in search, social media, and works with a subscriber base, this provides a stable flow of leads and increases total profit.

All this makes Mexico an extremely attractive geo for arbitrageurs: with relatively moderate competition, you can get a large volume of traffic and conversions with profitable payment for results. India is one of the world’s largest digital markets showing explosive growth in online financial services. Rapid urbanization, smartphone proliferation, and fintech development contribute to more and more Indians turning to online loans. According to forecasts, the volume of alternative online lending in India grew by 26% in 2024, to ~$9.5 billion. In the medium term, this market will increase by almost +18% CAGR until 2028 – incredible pace!

India is one of the world’s largest digital markets showing explosive growth in online financial services. Rapid urbanization, smartphone proliferation, and fintech development contribute to more and more Indians turning to online loans. According to forecasts, the volume of alternative online lending in India grew by 26% in 2024, to ~$9.5 billion. In the medium term, this market will increase by almost +18% CAGR until 2028 – incredible pace!

Today in India there are hundreds of microfinance apps and sites (LendingKart, CashBean, KreditBee, Bajaj Finserve, etc.) with millions of users. Demand is somewhat seasonal: for example, before holidays (Diwali and other festivals) many people take loans for purchases; also the start of the school year can give a spike in requests. However, overall demand remains consistently high year-round – economic difficulties and the desire to improve living standards push people to seek quick online credits.

In PDLP for India, a wide selection of offers is available: both CPL applications for credits and CPS issuances: Kredito24 IN (CPS1) – $7.50, SBI CREDIT CARD IN (CPS1) – 1720.00 INR, Paisa247 IN (CPL) – $0.80, Kotak 811 IN (CPS1) – 240.00 INR, YES BANK SAVINGS IN (CPS1) – 240.00 INR

Best results in India are usually given by Facebook/Instagram advertising and Google UAC (universal campaigns for promoting financial apps). Social networks here are a key channel: India is one of the largest Facebook markets (over 300 million users), YouTube, WhatsApp, Telegram are also popular. Through FB Ads you can drive traffic to pre-landings or lead forms, collecting contacts of potential borrowers.

Search traffic is also important: SEO for English and Hindi queries and context on keywords like “instant personal loan India” etc. can bring motivated leads. Given the high competition among MFIs in advertising, it’s important to stand out with creativity (emphasis on issuance speed – “15 minutes to your account”, on absence of paperwork, on first loan interest-free, etc.).

Conversions depend on the source: in organic search or on your own site they can be 10-15%, in social media lower (~5%), but this is compensated by cheap reach. Indian traffic is inexpensive (a click on Facebook can cost $0.05-0.1), so with good approaches ROI is very high.

India is a complex but extremely capacious market, and PDLP allows earning on it thanks to local offers and support from managers familiar with its nuances. Kazakhstan is one of the top CIS regions for online credits. The country’s population is ~19 million, 92% of whom have internet access (a very high indicator). Almost 81% of Kazakhs use banking services, however banks don’t issue consumer credits to everyone, so microfinance organizations thrive here. The microcredit market in Kazakhstan has experienced a “boom” in the last ~5 years – the fintech sector grows at double-digit rates, super-convenient mobile applications have appeared, integration with government services, electronic wallets (Kaspi.kz, Halva, etc.). As a result, most financial operations have moved online: 89% of transactions in the country are cashless.

Kazakhstan is one of the top CIS regions for online credits. The country’s population is ~19 million, 92% of whom have internet access (a very high indicator). Almost 81% of Kazakhs use banking services, however banks don’t issue consumer credits to everyone, so microfinance organizations thrive here. The microcredit market in Kazakhstan has experienced a “boom” in the last ~5 years – the fintech sector grows at double-digit rates, super-convenient mobile applications have appeared, integration with government services, electronic wallets (Kaspi.kz, Halva, etc.). As a result, most financial operations have moved online: 89% of transactions in the country are cashless.

For affiliates, this means the audience is completely accustomed to trusting digital financial services – meaning high conversion to credits. Kazakhs often take online loans until payday, for small business needs, for purchases. Seasonality is similar to other CIS countries: towards the end of the year demand increases (holidays), in summer there may be a small decrease. But generally, credits are taken year-round. Average microlaon size is ~30-50 thousand tenge ($65-110), for a term of 1 month with extensions.

In PDLP for Kazakhstan, offers from leading MFIs are available: for example Creditbar KZ (CPS1) – 10000.00 KZT, Qanat KZ (CPS1) – 13500.00 KZT, ACredit KZ (CPS1) – 10800.00 KZT, 1credit KZ (CPS1) – 13200.00 KZT, Credit365 KZ (CPS1) – 16100.00 KZT, CreditPlus KZ (CPS1) – 16000.00 KZT

Best conversion comes from contextual advertising to landing pages with application forms. Product teasers and clickbait news-style advertising are also effective – since the broad audience doesn’t mind clicking on an attractive headline about “credit in 5 minutes”. Facebook/Instagram in Kazakhstan are used less actively than in other geos, but they work for young audiences.

In Kazakhstan it’s important to filter traffic by solvency – at the creative or pre-landing level it’s worth cutting off completely non-target users (for example, students without jobs won’t get credits). If this is done, conversion to approval can be 20-30%.

Additionally, PDLP recommends using their Smartlinks for Kazakhstan – they automatically distribute traffic between offers (if one MFI rejects the user, the system will show them another). This way maximum benefit is extracted from each click. The Kazakhstan direction consistently brings high profit to many network partners. Romania is one of the most active online lending markets in Eastern Europe. Demand for quick payday loans among Romanians is very high, especially among those who can’t easily get a bank loan. In recent years, the Romanian microfinance sector has grown approximately 80% in credit portfolio, indicating enormous dynamics. MFIs actively implement digital solutions: almost all (94%) have moved to electronic contracts and 65% have completely digitized the loan issuance process.

Romania is one of the most active online lending markets in Eastern Europe. Demand for quick payday loans among Romanians is very high, especially among those who can’t easily get a bank loan. In recent years, the Romanian microfinance sector has grown approximately 80% in credit portfolio, indicating enormous dynamics. MFIs actively implement digital solutions: almost all (94%) have moved to electronic contracts and 65% have completely digitized the loan issuance process.

Romania has a fairly high level of internet usage (~80% of population), people are accustomed to e-commerce, so online financial services also gain trust. Seasonal spikes: before winter holidays many take loans (gifts, purchases), also in August-September (vacations and school preparation).

PDLP offers Romanian offers with payments for both leads and issued credits. For example, Sferacredit RO (CPS1) – 16.00€, CreditFix (CPS1) – 29.50€, OceanCredit RO (CPL – 8.00€, CPS1 – 16.00€, CPS2 – 24.00€, CPS3 – 28.00€, CPS4 – 8.00€), Horacredit RO (CPS1) – 50.00€, Ferratum RO (CPS1 – 90.00€, CPS2 – 33.00€, CPS 3 – 16.00€)

Content marketing and SEO work well in Romania – there are several large credit aggregator sites (for example, MrFinance.ro, etc.) that generate thousands of leads monthly. A new webmaster should focus on their niches – can do loan reviews on blogs, YouTube channels, collect email lists.

Targeted Facebook advertising also brings results: Romania has ~11 million Facebook users, and the platform allows precise ad targeting (by age, interests). It’s better to make soft creatives, without aggressive financial promises – for example, show a person buying their dream item thanks to a credit. Google Ads is a key channel for hot leads, but click price there can be higher since MFIs themselves compete. PDLP notes that Romanian offers give high approval – many MFIs approve >70% of applications since they work carefully with scoring and attract clients. Thus affiliates receive stable payments for most leads they bring.

Romania is a very profitable geo for those who know how to work with content and SEO, but arbitrageurs with paid traffic can also compete here thanks to quality creatives and careful optimization. Ukraine was one of the first markets PDLP specialized in, so the network has deep expertise here.

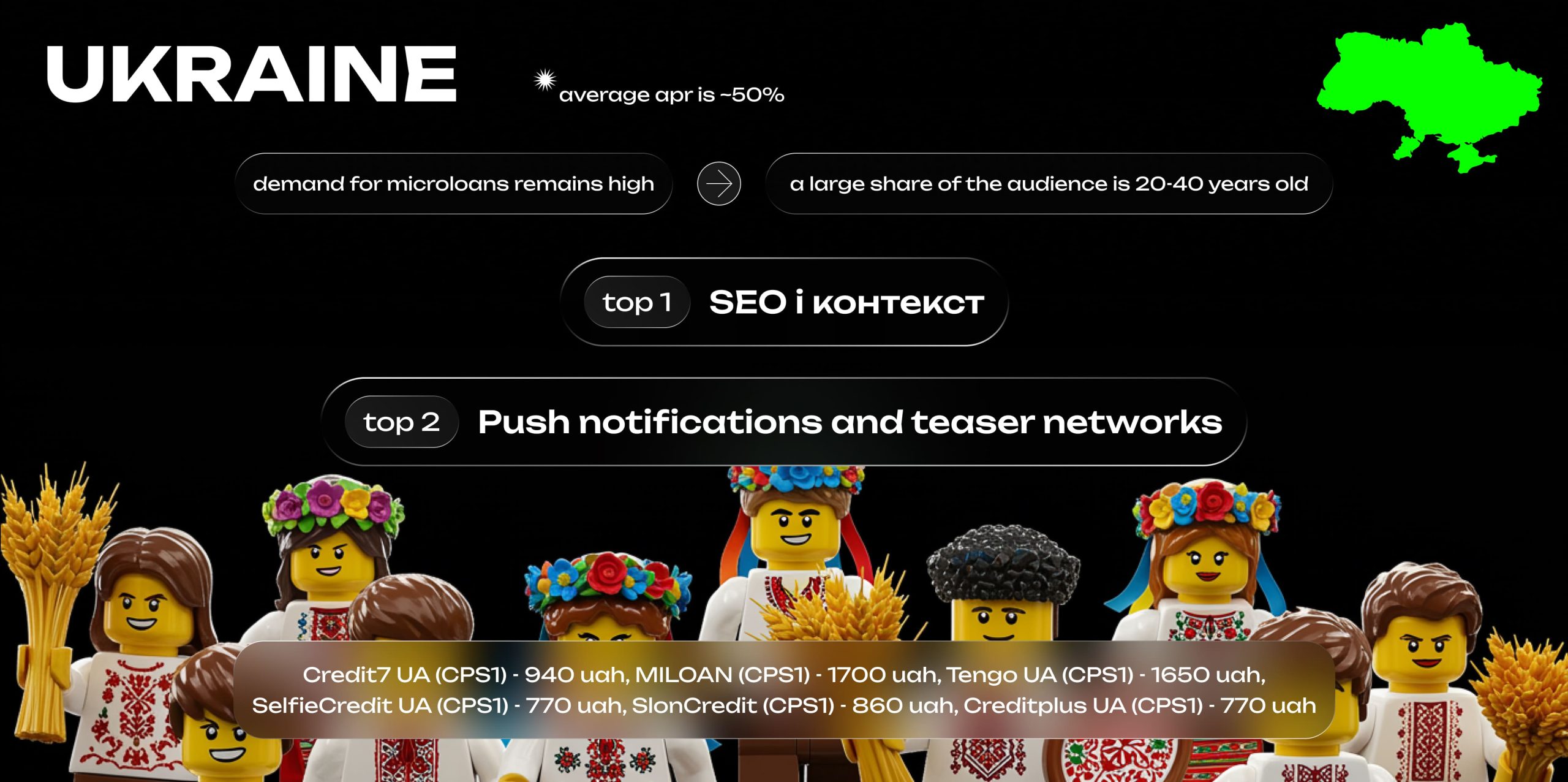

Ukraine was one of the first markets PDLP specialized in, so the network has deep expertise here.

Even before the war, the Ukrainian PDL market was extremely developed: hundreds of MFIs offered instant online loans, and demand from the population constantly grew.

The COVID-19 pandemic only strengthened the trend toward online credits. Currently, despite wartime economic difficulties, demand for microcredits remains high as many people need urgent funds for immediate needs.

The culture of using MFIs in Ukraine, like in Mexico, is still forming, meaning significant potential for new traffic. The state has introduced stricter requirements for microloans (interest rate limitations, debt collector control), but verified companies continue operating successfully. A large part of the audience is 20-40 years old, urbanites who value the speed and simplicity of online services.

In Ukraine, PDLP has exclusive offers from leading microfinance companies – including Credit7 UA (CPS1) – 940 uah, MILOAN (CPS1) – 1700 uah, Tengo UA (CPS1) – 1650 uah, SelfieCredit UA (CPS1) – 770 uah, SlonCredit (CPS1) – 860 uah, Creditplus UA (CPS1) – 770 uah, and dozens more. Some offers also pay for repeat credits from regular clients (RevShare up to 20-30%).

SEO and context give good traffic: Ukrainians often Google queries like “кредит онлайн на картку”, and sites with MFI reviews or comparisons have high CTR. Push notifications and teaser networks are also effective in Ukraine – many MFIs collaborate with them, so partners can replicate this. Lead→issued credit conversion depends on the specific MFI, but on average approval is ~50%. Webmasters value Ukrainian offers for stability: even in difficult times, PDLP continues providing traffic to advertisers and payments to partners.

If you have Ukrainian traffic, it monetizes as well as Western GEOs, with significantly lower cost per click. Philippines is among Southeast Asian countries where online lending is rapidly gaining momentum. About 70% of the adult population here isn’t covered by traditional banks, but almost everyone has a smartphone.

Philippines is among Southeast Asian countries where online lending is rapidly gaining momentum. About 70% of the adult population here isn’t covered by traditional banks, but almost everyone has a smartphone.

A Philippines feature is a very long Christmas season (“Ber months”) – from September to January people massively spend money on holidays. During this period there’s a spike in consumer spending: according to studies, 83% of Filipinos plan to spend money on family gifts for Christmas. This leads many families to seek borrowed funds, sometimes even turning to informal lenders at high interest, to finance holiday expenses.

For affiliates, this means a sharp increase in credit demand at year-end. At other times demand is uniform, with a slight drop after New Year and then growth toward the start of the school year.

PDLP actively works with the Philippine geo, having offers for different products: short PDL loans until payday, credit cards. Rates are mainly CPL for installation or application – for example, Digido APP (CPS 1) – $22.40, Kviku (CPS) – $5.25, Cashexpress (CPS) – $8, MoneyCat (CPS) – $11.2, Loanonline (CPS1 – $19.60 CPS2 – $10.50, CPS3 – $2.10)

What works best is Facebook – this social network here is practically = internet (over 80% of population uses Facebook). Through FB Ads with simple banners (person receiving money, happy family, etc.) you can easily generate thousands of clicks per day. Conversion from such campaigns isn’t high (2-5% to application), but cost per click is very low, so it turns out positive.

SEO in Philippines is more a niche for local sites, difficult for a foreigner, but if there are resources, you can try making English reviews (a significant part of the population speaks English). YouTube and TikTok are also promising: many young people seek financial advice on these platforms, so an app review or blogger advertising can give good referral flow. Philippine MFIs are relatively lenient – approval is usually ~40-50%. That is, out of 100 leads, half get a loan and generate payment.

Overall, Philippines is an excellent geo for those specializing in FB arbitrage in Western markets, and for traffic owners from Southeast Asia. Vietnam is similar to Philippines in terms of fintech development stage: population ~100 million, of which a significant part isn’t covered by banks, but almost all use smartphones and internet. Online loans became popular in the last ~5 years, with known brands operating both local (Momo, MFast) and international (MoneyVeo, Robocash).

Vietnam is similar to Philippines in terms of fintech development stage: population ~100 million, of which a significant part isn’t covered by banks, but almost all use smartphones and internet. Online loans became popular in the last ~5 years, with known brands operating both local (Momo, MFast) and international (MoneyVeo, Robocash).

In Vietnam, loans are often taken by young professionals, beginning entrepreneurs. Seasonally, high demand is observed before the traditional Tet (Vietnamese New Year) – in January-February many people need money for trips, gifts, celebrations. After holidays there may be a small drop in issuances. But generally, the year’s trend is increasing demand for microlending, parallel to economic growth.

Among PDLP offers in Vietnam, one of the most popular is MoneyVeo VN – a Ukrainian brand successfully launched in Asia. It works on CPS model with payment around $12.25 per lead, which is very attractive. Also available: VAYVND VN (CPS) – $16, Moneycat VN (CPS) – $12, Dong247 VN (CPS 1 – $14.70, CPS 2 – $10.50, CPS 3 – $3.50), Finpug VN (CPL) – $0,7

Traffic works well from Google Ads and SEO – Vietnamese is complex, competition isn’t too high, so whoever can make Vietnamese content can get top positions.

Facebook in Vietnam is used by millions, so FB Ads is the second key channel. Here it’s important to localize creatives (use Vietnamese texts, images). Another specific channel is Zalo Ads (local messenger Zalo is very popular and has its own ad network). Through Zalo you can reach audiences not on global social networks. In Vietnam, PDLP recommends testing different approaches: some offers convert better with direct traffic, others need pre-landing with explanations. Conversion to approval is average (~30%).

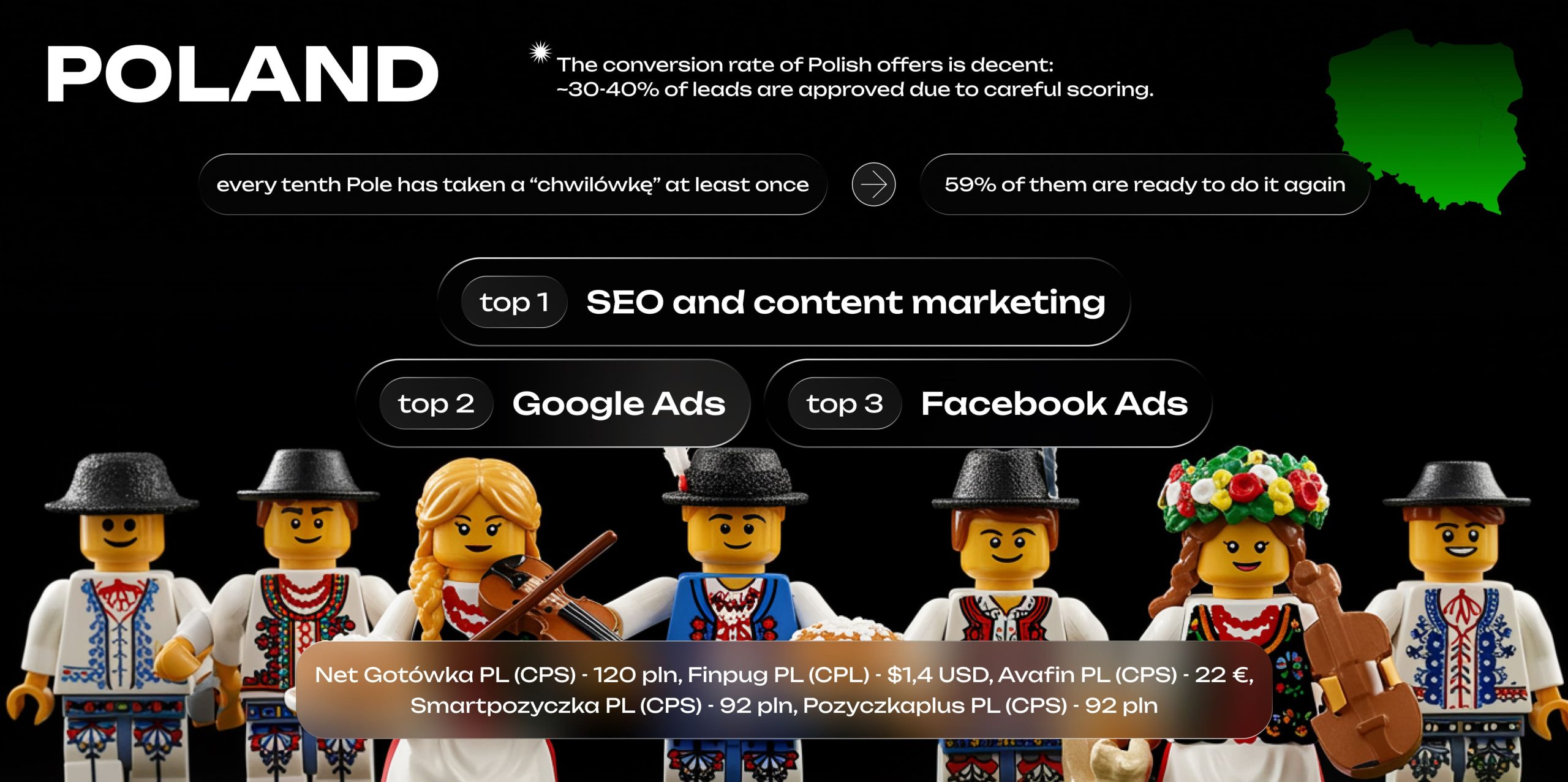

Overall, the Vietnamese direction can become a “dark horse” in the webmaster’s arsenal – with relatively small efforts you can get cheap traffic and decent payments in dollars. Poland is a developed European market where the quick online credit niche has also found its place. Poles have quite a few alternatives (banks, credit cards), but microloan popularity remains high. According to surveys, every tenth Pole has taken at least one “chwilówkę” (microcredit) and 59% of them are ready to do it again. This indicates quite a positive consumer attitude toward such services. The country has dozens of MFIs operating, including large international ones – Net Gotówka, Finpug, Avafin, Smartpozyczka, Pozyczkaplus. Audience ~38 million, high level of digital literacy, so traffic volumes are large. Seasonality: before Christmas holidays many Poles take credits for gifts, summer vacation loans are also popular.

Poland is a developed European market where the quick online credit niche has also found its place. Poles have quite a few alternatives (banks, credit cards), but microloan popularity remains high. According to surveys, every tenth Pole has taken at least one “chwilówkę” (microcredit) and 59% of them are ready to do it again. This indicates quite a positive consumer attitude toward such services. The country has dozens of MFIs operating, including large international ones – Net Gotówka, Finpug, Avafin, Smartpozyczka, Pozyczkaplus. Audience ~38 million, high level of digital literacy, so traffic volumes are large. Seasonality: before Christmas holidays many Poles take credits for gifts, summer vacation loans are also popular.

In Poland, PDLP offers several interesting propositions, for example Net Gotówka PL (CPS) – 120 pln, Avafin PL (CPS) – 22 €, Smartpozyczka PL (CPS) – 92 pln, Pozyczkaplus PL (CPS) – 92 pln

SEO and content marketing are very developed: large comparison portals exist (loando.pl, pozyczkaportal.pl, etc.) that capture the lion’s share of organic traffic. But you can occupy narrow niches: for example, make a site for credits for foreigners in Poland (there’s demand among labor migrants) or target queries about credits with bad credit history.

Google Ads is effective, though quite expensive – average cost per click in financial topics can be 1-2 €.

Facebook Ads in Poland also works, especially for youth, but FB policy in the EU is stricter, so it’s better to use creative agency services or work with retargeting for those who already visited your site.

Polish offer conversion is decent: thanks to careful scoring, applications from ~30-40% of leads are approved. Spain is one of the key EU markets where the online loan niche formed after the 2008 crisis. Many Spanish and international MFIs operate here (Finpug, Luzo, Kviku, etc.). Demand is consistently high among populations with medium and low income. Spaniards value the speed and simplicity of online credits. Seasonality: peak before Christmas, also many loans are taken in autumn (after vacations when debts arise).

Spain is one of the key EU markets where the online loan niche formed after the 2008 crisis. Many Spanish and international MFIs operate here (Finpug, Luzo, Kviku, etc.). Demand is consistently high among populations with medium and low income. Spaniards value the speed and simplicity of online credits. Seasonality: peak before Christmas, also many loans are taken in autumn (after vacations when debts arise).

PDLP provides Spanish offers with payments in euros. For example, Finpug ES (CPL) – 1.50 €, per application, Luzo ES (CPS1) – 27 €, Kviku ES (CPS1) – 8.33 € per issued credit.

In Spain there’s high competition in Google Ads – often MFIs themselves and large affiliates buy top results. Therefore, beginners should better focus on Facebook/Instagram advertising and native ads.

Bright banners and teasers “Money in 15 min to your card” interest Spaniards, clickability is good. Conversion from social media then depends on the landing: it’s advisable to send traffic to a chain with several offers, to increase the chance that at least somewhere the user gets approved for credit. PDLP has tools (smartlinks, showcase landings) for this – you can create a “Best préstamos rápidos 2025” showcase and gather 5-10 top MFIs on it.

Approval in Spain is high for verified leads: some aggregators report up to 90+% approval (because they select a lender for each client who will almost guaranteed approve). On average in the market, about 60-70% of applications end in issuance.

Therefore, from a monetization perspective, Spanish traffic is very valuable – almost every lead produces results. Strong Specialization and Exclusive Offers

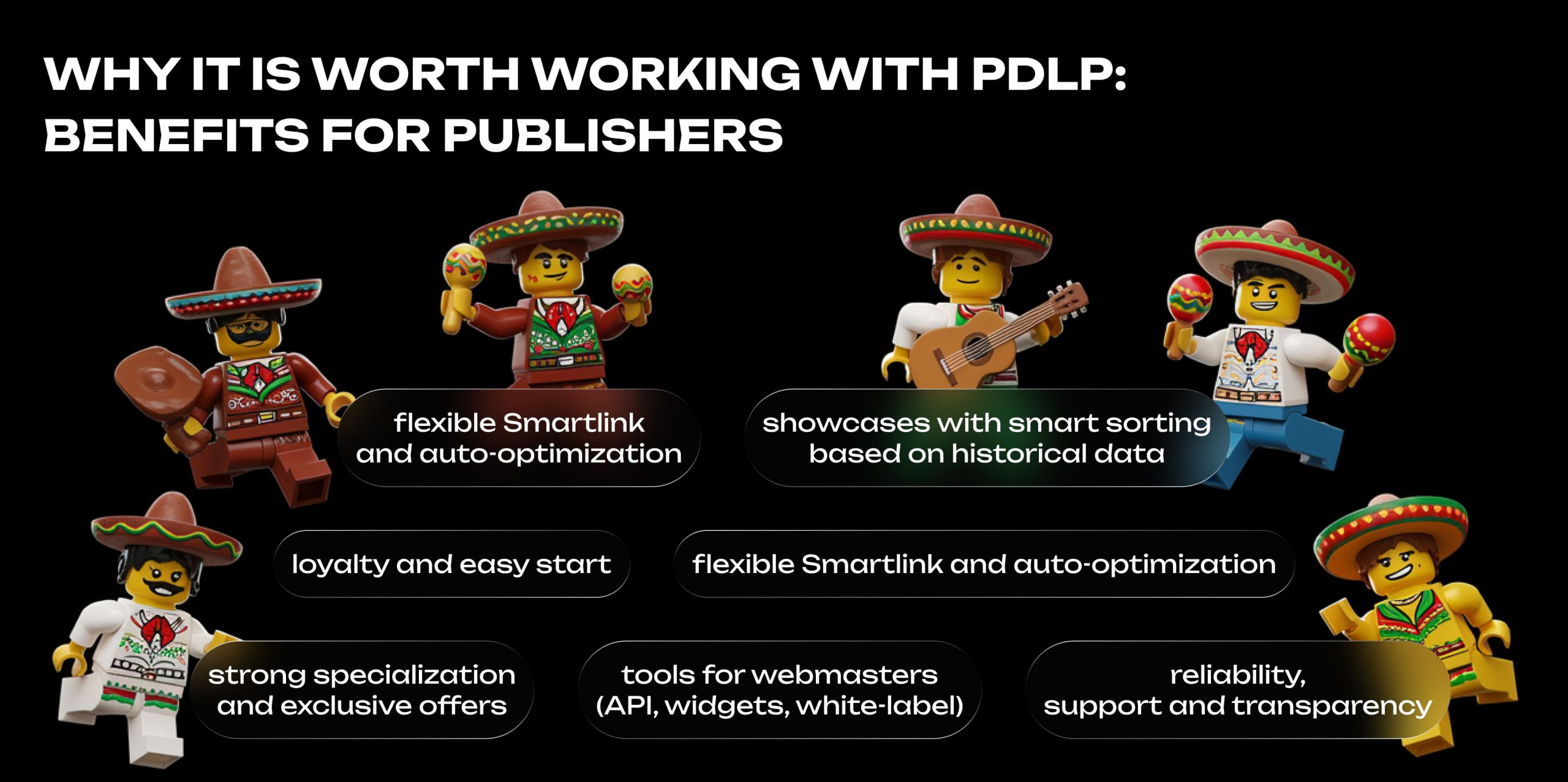

Strong Specialization and Exclusive Offers

The network focuses on the financial vertical, so you get verified PDL/Loan offers with high rates. Many propositions are exclusive, from reliable MFIs. Each geo features top brands (Vivus, Moneyveo, Kueski, etc.) – conversion is guaranteed thanks to user recognition and trust. PDLP constantly updates its offer pool and adds new GEOs upon partner request – if needed, they can connect the required advertiser within days.

Loyalty and Easy Start

To begin, you don’t need to be a guru – managers will help select offers for your traffic. Practically any traffic without fraud is accepted: context, doorways, social media, push, native, vloggers, email broadcasts, etc. (only incentivized and deceptive schemes are prohibited). This way you can monetize existing traffic with minimal changes. PDLP gives beginners bonuses (for example, +5% to payouts in the first month) and free tools (up to 4k SMS to start campaigns), which facilitates entry. Absence of payout holds is especially valuable – you quickly get profits and can scale advertising.

Flexible Smartlinks and Auto-optimization

A unique PDLP feature is intelligent Smartlinks for each vertical/geo. You just need to drive traffic to one link, and then the system will distribute users to offers where there’s higher conversion probability. Smartlink guarantees each click gets the best proposal: if the first MFI rejects, the next will be shown, etc. The result is more earnings from the same traffic volume.

Showcases with Smart Sorting Based on Historical Data

A separate PDLP advantage is availability of dynamic showcases that can be integrated into your site or used as a separate landing page. Such showcases automatically display offers in advantageous order, using analytics from historical conversions, approval rates, EPC and geo-targeting. For example, if a certain MFI has the highest conversion in Mexico over the last 7 days – it will automatically be shown first in the list.

This allows:

- increasing conversion probability thanks to better offer placement;

- reducing losses on irrelevant clicks;

- constantly updating display without manual moderation.

A webmaster can connect such a showcase to their domain or use a PDLP subdomain, choose style, language, number of offers, sorting logic. This is an ideal tool for those who want to start quickly without development and testing. Smart showcases aren’t just an offer list, but an algorithmically optimized system that considers user behavior and profitability of each offer in specific context.

Tools for Publishers (API, Widgets, White-label)

PDLP offers technical solutions for experienced partners: full API for integrating own sites and apps, ready credit application widgets, as well as showcase site builder. In minutes you can deploy a landing page with MFI list for the needed country – all data (rates, descriptions) are already pre-filled, templates verified by design for conversion. You can use your own domain and fully customize – essentially getting a white-label microfinance site under your own brand. This is a huge advantage for those who don’t have resources to make their own landings from scratch. There’s also SMS sender tool – free SMS broadcasts (up to 4,000 pieces/month) to your base, convenient for lead activation.

Reliability, Support and Transparency

PDLP emphasizes honest collaboration: all offer conditions are open, no lead “shaving” or hidden rules. Payouts – daily and on time, with payment methods of choice (from PayPal to crypto). The network has earned a reputation as reliable – webmasters especially note that even during crisis moments, the network continued paying what was honestly earned. Support is a separate plus: 24/7 available via Telegram, email, with a personal manager you can discuss any idea or problem. Beginners get help optimizing campaigns, advice on connections, current creatives, allowed texts, etc.

For top partners, individual conditions are available (increased rates, no payout commissions, etc.). The network operates a referral program – you can invite a colleague and receive a % of their income. There’s also an implemented ranking and points system: points are accrued for traffic volume which can offset withdrawal fees. If you’re looking for a way to monetize your traffic with credit offers – whether in Latin American, Asian, or European markets – the PDLP affiliate network will provide you with tools, offers and support for successful results.

If you’re looking for a way to monetize your traffic with credit offers – whether in Latin American, Asian, or European markets – the PDLP affiliate network will provide you with tools, offers and support for successful results.

Join and turn your traffic into stable profit with PDLP!